Click Here To Get My Free Doncaster Property Investment Guide

Build Long-Term Wealth Without Disrupting Your Career...

For Senior Technical & Corporate Professionals Who Want More Time, More Control, and a Clearer Financial Future

You work in high-responsibility environments. Precision matters.

So does control. Every decision you make has consequences. People rely on you to get it right.

But while your career keeps moving, your money?

It’s just sitting there. Earning little. Going nowhere fast.

You’ve likely thought about investing. Maybe even property.

But between the risks, the noise, and the time commitment, it never feels like the right moment.

Leger Property Solutions

.One that works in the background while you stay focused on what you do best.

Structured. Hands-free. Designed for clarity, not chaos.

We call it The Leger Wealth Pathway and it’s built specifically for professionals who want a smarter route to long-term wealth.

This is a structured, risk-managed system built for people who value logic, clarity, and freedom, not noise and hype.

Build Long-Term Wealth Without Disrupting Your Career...

For Senior Technical & Corporate Professionals Who Want More Time, More Control, and a Clearer Financial Future

You work in high-responsibility environments. Precision matters.

So does control. Every decision you make has consequences. People rely on you to get it right.

But while your career keeps moving, your money? It’s just sitting there. Earning little. Going nowhere fast.

You’ve likely thought about investing. Maybe even property. But between the risks, the noise, and the time commitment, it never feels like the right moment.

Leger Property Solutions

.One that works in the background while you stay focused on what you do best.

Structured. Hands-free. Designed for clarity, not chaos.

We call it The Leger Wealth Pathway and it’s built specifically for professionals who want a smarter route to long-term wealth.

This is a structured, risk-managed system built for people who value logic, clarity, and freedom, not noise and hype.

Is This Starting to Sound Familiar?

You’ve built a solid career. You’re trusted to lead. To deliver. To get it right.

But you’re paying for it in other ways.

Time with family is limited.

Hobbies, health, even just thinking space... pushed aside.

Even when you're off the clock, your mind isn’t.

There’s always more to do. And beneath it all, a quiet thought lingers:

“Is this sustainable? What am I building for the future?”

You’ve likely looked at other options. Maybe even property.

It seems logical. A proven way to grow wealth.

But the time, the risk, the noise... it’s all too much on top of everything else.

So you park the idea. And time keeps moving.

But deep down, you know the risks…

Your Career Won’t Stay Certain

Industries change, restructures happen, and even senior roles aren’t guaranteed forever. Stability today doesn’t always mean security tomorrow.

Your Pension May Fall Short

The numbers often don’t add up. Rising costs and longer retirements mean your pension alone may not cover the lifestyle you expect.

Time for Money Isn’t Sustainable

Trading hours for income works now, but not forever. Eventually, you’ll want freedom, not another decade tied to the grind.

You want more clarity. More margin.

More time for what actually matters.

The good news?

You don’t need to quit your job. Or gamble your savings. Or figure it all out yourself.

There’s a different path.

One that works in the background. Quietly. Steadily.

While you keep moving forward.

That’s exactly what The Leger Wealth Pathway is designed for.

A structured, risk-managed system that builds long-term wealth without adding to your workload.

Hands-free. Transparent. Built for professionals who don’t want more stress, just more control.

A structured, risk-managed system that builds long-term wealth without adding to your workload.

Hands-free. Transparent. Built for professionals who don’t want more stress, just more control.

Chris Robison - Legacy Property Partners

I have known Dominic for coming up 12 months now, and in that time, his help, guidance, and knowledge has been extremely helpful in my property journey. His creative thinking has really helped me think out of the box and see property investing from a totally different perspective.

I like the way Dominic’s work ethic and attention to detail is 10/10. His dedication to getting the BEST solution to any issue, in a timely manner, has been great to see.

The property insight and advice I receive every time I meet up with Dominic has been invaluable. His advice has saved me a lot of time and money!

Dominic’s communication throughout has been perfect. I know I can always trust him to check in with me and give me honest updates, without having to chase him up or check his work.

I cannot recommend Leger Property Solutions highly enough. Their property knowledge, advice, work ethic, and dedication to you is beyond perfect. Thank you.

Chris Robison

Legacy Property Partners

I have known Dominic for coming up 12 months now, and in that time, his help, guidance, and knowledge has been extremely helpful in my property journey. His creative thinking has really helped me think out of the box and see property investing from a totally different perspective.

I like the way Dominic’s work ethic and attention to detail is 10/10. His dedication to getting the BEST solution to any issue, in a timely manner, has been great to see.

The property insight and advice I receive every time I meet up with Dominic has been invaluable. His advice has saved me a lot of time and money!

Dominic’s communication throughout has been perfect. I know I can always trust him to check in with me and give me honest updates, without having to chase him up or check his work.

I cannot recommend Leger Property Solutions highly enough. Their property knowledge, advice, work ethic, and dedication to you is beyond perfect. Thank you.

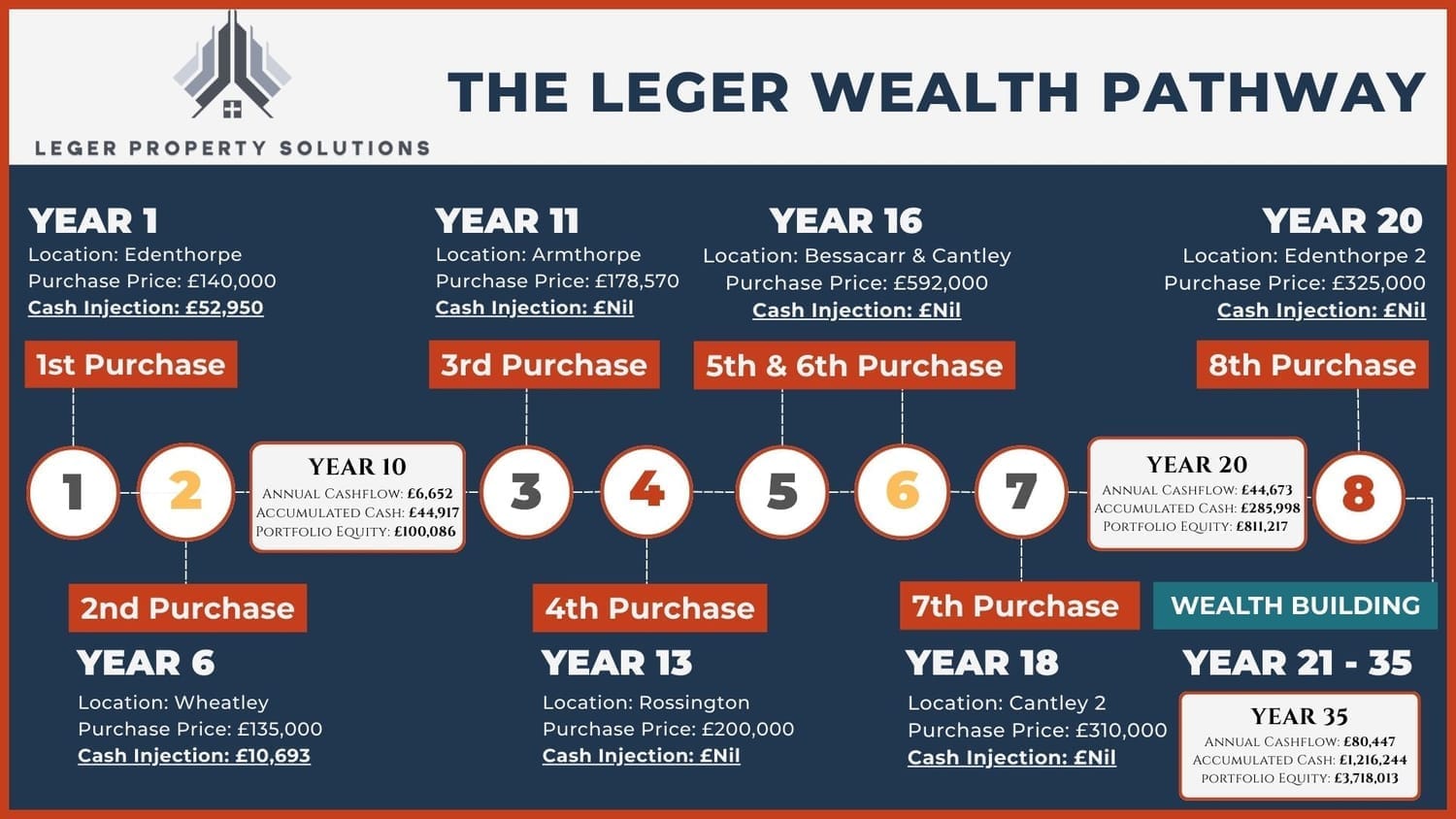

The Leger Wealth Pathway

A clear route to building long-term wealth through property

You put in structured capital at the start.

The asset grows.

Rents rise.

Equity is released and recycled.

Your wealth compounds over time while you stay focused on your career.

How the pathway works

Acquire well

Buy in strong Doncaster postcodes with realistic prices, solid yields, and steady demand.

Improve where it counts

Light upgrades where needed to lift rent, appeal, and valuation.

Let and hold

A professional agent manages tenants, rent, and compliance. You stay hands off.

Refinance to release equity

When values rise, release a portion of equity to fund the next purchase.

Repeat with discipline

Reinvest equity and surplus cashflow. Grow the portfolio step by step.

How the Leger Wealth Pathway Builds Over Time

This is an illustration of how your wealth compounds when you follow a structured, hands-free strategy.

Year 1 – First step onto the ladder

You purchase your first property in Doncaster for around £140,000, with an initial cash injection of just under £53,000. This sets the foundation for everything that follows.

Year 6 – Second property added

Your first property has grown in value. By refinancing and adding around £10,000 of new funds, you secure a second property worth £135,000.

After this, no further personal cash injections are needed

Year 10 – Growth becomes visible

At this point, your portfolio is generating over £6,600 in annual cashflow. You’ve built up nearly £45,000 in accumulated cash, and your equity position has passed £100,000.

Year 11 to Year 13 – Scaling without more cash

Using equity, not new savings, you add a third and fourth property. Together they’re worth nearly £380,000 and no further injections are required.

Year 16 – Momentum accelerates

By now, the portfolio supports the purchase of two more properties, valued at almost £600,000 combined. Again, funded entirely through portfolio refinancing.

Year 18 – A seventh property joins the portfolio

Another refinance unlocks the capital needed to purchase a £310,000 property. Still no fresh cash required from you.

Year 20 – Strong cashflow, strong equity

Annual rental income is now around £44,000. You’ve built up £285,000 in cash reserves, and your equity stands at more than £800,000.

An eighth property is added, this time worth £325,000. Again without dipping back into your own pocket.

Years 21 to 35 – Wealth compounding in the background

From this point on, the portfolio works quietly for you. Rents rise. Equity builds. Capital compounds.

By Year 35, you’re looking at:

£80,000+ annual rental income

£1.2M in accumulated cash

Over £3.7M in portfolio equity

And all of this was created using only around £63,000 of your own money.

Why this works

Two engines of growth

Capital appreciation and rental uplift support both equity and income.

Recycling capital

Refinancing at the right time lets you scale without repeatedly saving large deposits.

Time efficient

Day to day is managed by trusted local teams. You approve key decisions, not the paperwork.

What you bring. What we do.

You

Clear goals, available capital, sensible time horizon.

We

Plan, property selection, purchase management, improvements, letting setup, and ongoing reviews against the pathway.

Your outcome is a portfolio that compounds quietly, with structured checkpoints and clear options at each stage.

The earlier you begin, the bigger the outcome.

Are you curious to find out if The Leger Wealth Pathway can help you reach your investment goals? Let’s have a quick chat and see if it’s the right fit for you.

Scott Turton | Mi Casa Su Casa Properties Ltd

I have been working with Dom now for a number of months as part of a large property network. Dom is committed to learning and always improving in order to ensure his clients and peers are also able to learn and improve on their collaborative journey. He has an incredibly strong work ethic which translates in to his approach to providing insightful and meaningful advice that adds value to every conversation.

We regularly discuss challenges we come across in the property world which easily become a two-way conversation thanks to Dom's easy-going nature and ability to listen, repeat and work through what is being discussed. Dom is brilliant to be around, often adding humour and every day chat to any discussions we have and is somebody I am proud to have in my network. I am absolutely certain that we will continue to work together for many years to come.

Scott Turton |

Mi Casa Su Casa Properties Ltd

I have been working with Dom now for a number of months as part of a large property network. Dom is committed to learning and always improving in order to ensure his clients and peers are also able to learn and improve on their collaborative journey. He has an incredibly strong work ethic which translates in to his approach to providing insightful and meaningful advice that adds value to every conversation.

We regularly discuss challenges we come across in the property world which easily become a two-way conversation thanks to Dom's easy-going nature and ability to listen, repeat and work through what is being discussed. Dom is brilliant to be around, often adding humour and every day chat to any discussions we have and is somebody I am proud to have in my network. I am absolutely certain that we will continue to work together for many years to come.

The Straightforward Guide to Building Wealth Without Adding More to Your Plate

Discover how busy technical and corporate professionals are using hands-free property investment to grow their net worth – without the stress.

Understand how Buy-to-Let works in the background while you stay focused on your career.

See why Doncaster is outperforming the headlines – and how others are quietly building long-term wealth there.

Follow a proven, 5-step system designed for busy people who want more time, not another job.

Fill in your details below – the full guide will be sent to your inbox in the next couple of minutes.

Why Choose Doncaster?

A Long-Term Wealth Market Hiding in Plain Sight

Doncaster isn’t just “good value.” It’s a smart, strategic location for professionals who want to grow their net worth through long-term asset performance.

Yields of 7%+ are still achievable in the right areas.

Property prices between £130K–£150K keep the capital entry point realistic.

Tenant demand is growing due to affordability, employer growth, and relocation activity.

Regeneration is accelerating – with over £400M in investment already committed.

While southern markets are overcooked and heavily leveraged, Doncaster is still early in the curve. That gives investors a window to secure better income now and stronger growth over time.

Why It Works for Wealth Building

Capital Growth, Income Uplift, and Long-Term Leverage

You’re not just looking for cashflow. You want long-term wealth.

Here’s how Doncaster helps you build it:

Capital growth: Properties here have steadily appreciated over the last decade – and ongoing regeneration means that trend is set to continue.

Rental uplift: As demand rises and wages adjust, rents are following. That increases monthly income year-on-year without changing your asset base.

Equity leverage: Growth means refinancing potential. That equity can fund your next property, compounding your gains without needing to save from scratch.

Add in consistent yields and manageable purchase prices, and it’s a rare combination: income today, upside tomorrow.

Why Doncaster Works Remotely

A Local Market, Managed for People Who Aren’t

Most investors don’t live near their investment properties. And that’s fine because with the right structure in place, you don’t need to.

We are based in Doncaster and have been actively building our own property portfolio here. We know the streets, the agents, the demand. And we've built trusted local relationships with the teams that make this work.

You won’t be left guessing or chasing trades.

You’ll be working with someone who’s on the ground and understands what makes this market tick.

Whether you live two hours away or overseas, the process is designed to work without you needing to be local, involved, or hands-on.

Why Doncaster Is on the Up

Major Infrastructure Upgrades

£25M+ invested in City Gateway & Doncaster Station. New public realm, better connectivity, and a rising commuter population.

Growing Employment Hubs

New Digital Tech Hub and logistics parks bringing high-quality jobs and long-term rental demand to the area.

Regeneration Backed by Funding

Hundreds of millions committed through government and private investment. Not just plans, these projects are happening.

Property Market with Headroom

Affordable entry prices, rising rental demand, and long-term capital growth make Doncaster ideal for wealth-focused investors.

Meet Dominic

Founder of Leger Property Solutions

Hi, I’m Dom.

I’m not a sales guy. I’m not a flashy property guru. I’m someone who works in a high-pressure industry, just like you.

By day, I’m Head of Risk, Safety and Compliance at a major aviation firm. It’s a demanding role. One where precision, responsibility and foresight aren’t optional. They’re essential. I’ve spent years leading under pressure, solving complex problems, and making decisions where the stakes are high.

So when I started investing in property, I brought that same mindset with me. Structured. Risk-aware. Data-driven.

I began with residential flip projects here in Doncaster. Learned the process. Saw the returns. But more importantly, I realised I didn’t want a side hustle that just created more work. I wanted a long-term plan. A way to build steady wealth without sacrificing my time, energy, or focus.

That’s why I created Leger Property Solutions.

It’s not about flipping houses or selling dreams. It’s about building long-term financial stability for people like us. People who already carry a lot on their shoulders and want a smarter way to grow their wealth without adding more stress.

Everything we do is built around trust, transparency and control. No hidden fees. No hype. Just a clear, hands-free approach designed for technical and corporate professionals who want to build something meaningful for their future.

You’ve worked hard to get where you are.

If you’re ready to make your money work just as hard without it taking over your life, I’d love to help.

Tracey Marshall | Eliver Properties Ltd

I’ve worked with Dominic for a while now, and his commitment, passion, and knowledge of the property market really stand out. He always comes up with practical solutions and goes the extra mile to deliver outstanding service.

I’ve often gone to him when I wasn’t sure how best to use my funds or property. I trust his advice completely. He’s given me ideas I wouldn’t have thought of myself, saving me both time and money.

What I value most are his ethics and values. Dominic is professional and passionate about what he does, but also down to earth and easy to talk to. He’s quick to respond, communicates clearly, and always makes sure I feel supported.

I wouldn’t hesitate to recommend Dominic to anyone looking for property advice. You’ll be in safe hands with him, and his dedication to impeccable service makes him my go-to property expert.

Tracey Marshall | Eliver Properties Ltd

I’ve worked with Dominic for a while now, and his commitment, passion, and knowledge of the property market really stand out. He always comes up with practical solutions and goes the extra mile to deliver outstanding service.

I’ve often gone to him when I wasn’t sure how best to use my funds or property. I trust his advice completely. He’s given me ideas I wouldn’t have thought of myself, saving me both time and money.

What I value most are his ethics and values. Dominic is professional and passionate about what he does, but also down to earth and easy to talk to. He’s quick to respond, communicates clearly, and always makes sure I feel supported.

I wouldn’t hesitate to recommend Dominic to anyone looking for property advice. You’ll be in safe hands with him, and his dedication to impeccable service makes him my go-to property expert.

Real Investment Examples: How Wealth Builds Over Time

These aren’t theories. These are real properties that have been carefully selected and managed as part of a long-term strategy.

Each one shows how capital growth, rising rents, and reinvestment all work together to quietly build wealth in the background.

Let's Start a Conversation!

A simple, step-by-step process designed to move at your pace — not pressure you into a decision.

Here’s how it works:

Step 1: Quick Qualification Call

A short, no-pressure call to understand your goals, answer initial questions, and check if this approach is the right fit.

Step 2: Strategy Planning Session

If there’s alignment, we’ll move into a more detailed conversation. Together, we’ll build out a tailored investment plan based on your timeframe, capital, and preferences.

Step 3: Property Selection & Purchase

We identify properties that match your plan and manage the full purchase process on your behalf. You stay in control of key decisions, without the day-to-day admin.

Step 4: Long-Term Growth & Scaling

Once the first property is up and running, we look at next steps. Whether that’s equity release, reinvestment, or simply holding — we’ll guide you at every stage.

Frequently Asked Questions

A: We focus exclusively on buy-to-let investments in Doncaster. It’s a market we know inside out, with strong fundamentals, steady yields, and room for long-term growth.

Typically, 2–3 bed houses in established residential areas. These properties attract reliable tenants, deliver 7-8%+ gross yields, and offer great potential for capital appreciation.

We aim to present initial opportunities within 6–12 weeks, though it can be sooner depending on your investment goals and the market at the time.

Not at all. Many of our clients are based elsewhere in the UK or overseas. We manage the entire process locally so you can stay hands-off.

Minimal. You approve the key decisions (such as property purchase and refinance timing), but day-to-day management is handled by trusted local partners.

It’s a 5-step system: acquire well, improve where it counts, let and hold, refinance to release equity, and repeat. This structured approach compounds wealth over time while you stay focused on your career.

For a typical buy-to-let property, our sourcing fee starts at £5,000. All fees are agreed transparently upfront.

All investments carry risk, but we focus on risk-managed, logic-led decisions. We target steady-growth areas, avoid speculation, and ensure you have full visibility at every stage.

Yes. We provide regular check-ins, portfolio reviews, and guidance on refinance or reinvestment opportunities so your plan stays on track.

Typically £50,000-£60,000 is required to comfortably cover deposit, fees, and setup costs for a high quality buy-to-let in Doncaster.

Contact Me

Leger Property Group Ltd

Twelve Quays House

Egerton Wharf

Wirral

CH41 1LD

Let’s Discuss Your Investment Goals

Ready to start building long-term wealth through hands-free property investment?

Click below to arrange a no-obligation call with Dom and explore how The Leger Wealth Pathway can help you reach your financial goals.

© Copyright 2025 | Leger Property Group Ltd | Company No. 15939788